Leveraging Life Insurance for Capital Dividend Account (CDA) Growth

In today’s dynamic financial landscape, strategic planning is key to enhancing your financial security and growth. One powerful tool that often goes underutilized is life insurance. In this blog, Royal Rock Wealth will explore how life insurance can be strategically leveraged to expand your Capital Dividend Account (CDA) while ensuring financial security for your loved ones. By understanding the relationship between life insurance and your CDA, you can uncover valuable opportunities for tax efficiency and enhanced wealth preservation.

How to Accumulate CDA Credits ?

There are six main ways to accumulate CDA credits, with two being the most common:

- Capital Gains: When your company realizes capital gains, only 50% of the gain is taxable, while the other 50% is tax-exempt and can be added to your CDA. For example, if your company sells stocks for a profit of $15,000, half ($7,500) would be tax-free and credited to your CDA.

- Subsidiary Dividends: If your company owns another company, dividends from that subsidiary can be transferred tax-free to the parent company’s CDA. For example, if your subsidiary generates $20,000 in capital gains, that amount can be passed to the parent company’s CDA.

Once credits accumulate in your CDA, you can apply to the tax authorities for a tax-free distribution of dividends.

Enhance Your Capital Dividend Account Through Life Insurance Strategies

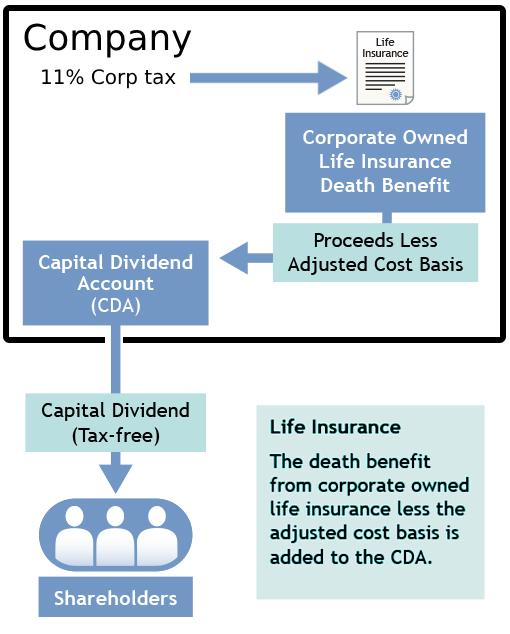

One of the lesser-known but highly beneficial ways to grow a CDA is through life insurance. In fact, life insurance policies can amplify the tax advantages offered by a CDA in several ways:

- Tax-Deferred Growth: Contributions to certain types of insurance policies, such as dividend-paying life insurance, grow tax-deferred, much like an investment. Over time, this increases the overall value of the policy, and the growth remains tax-free.

- Death Benefits: If the company holds a life insurance policy on an owner or key shareholder, the death benefit paid to the company is tax-free and can be added to the CDA. This allows the death benefit to be distributed tax-free to the shareholder’s heirs, which is particularly useful for family businesses aiming for smooth wealth transfer.

- Adjusted Cost Base (ACB): The insurance’s ACB is the cost of the policy over time. As the policyholder ages, the ACB decreases, allowing the company to add a larger portion of the death benefit to the CDA. In some cases, 100% of the insurance proceeds can be added to the CDA, making life insurance a powerful tool in both tax and estate planning.

Example of Life Insurance with CDA

Let’s say a business owner has a life insurance policy worth $5 million. Upon their death, the insurance company pays the $5 million to the business. If the ACB of the policy is $0, then the entire $5 million can be credited to the company’s CDA. This amount can then be distributed tax-free to the owner’s heirs, ensuring a smooth and tax-efficient transfer of wealth.

Why Life Insurance is Essential for Tax Planning

Incorporating life insurance into a CDA strategy not only optimizes the tax benefits but also offers peace of mind by ensuring financial protection for heirs. It combines the advantages of tax deferral, wealth growth, and estate planning into one cohesive strategy, making it a critical component for business owners in Canada looking to minimize tax burdens.

Contact Royal Rock Wealth: Your Certified Insurance Advisor in Richmond

For further understanding of CDAs and integrating life insurance into your tax strategy, you may refer to guidelines from the Financial Consumer Agency of Canada (FCAC) or contact a certified insurance advisor at Royal Rock Wealth in Richmond

Overall, the CDA is a versatile tool, but its full potential can be unlocked by integrating other financial products, such as life insurance, to protect and enhance your business legacy.

Contact Royal Rock Wealth today and learn more about how life insurance can support your financial goals and secure a brighter future for you and your loved ones.